By Bianca C. Wittenberg

California Real Estate Broker Since 2010

The collecting of real estate assets is a rewarding adventure. The ultimate goal is to buy, and keep or upgrade real estate assets to build a larger real estate portfolio. When you no longer have a regular income, with proper planning your asset portfolio can be paid off, providing the ability to retire comfortably. In an effort to help investors achieve this goal, the government offers the right to do a 1031 exchange when selling one “like kind” property for another. The exchange provides certain tax relief benefits and allows property owners more flexibility when trying to upgrade their properties.

What is the purpose of a 1031 exchange?

The purpose of an exchange is being able to upgrade an investment without having to pay capital gains tax on profits immediately during the sale. Instead, one may want to participate in a 1031 exchange, deferring tax liability. This helps investors, who typically will not be acquiring “cash” from the transaction, avoid large tax liabilities. The capital gains tax only has to be paid if a property, previously involved in an exchange, is sold for profits and is not participating in a further exchange.

How do I begin a 1031 exchange?

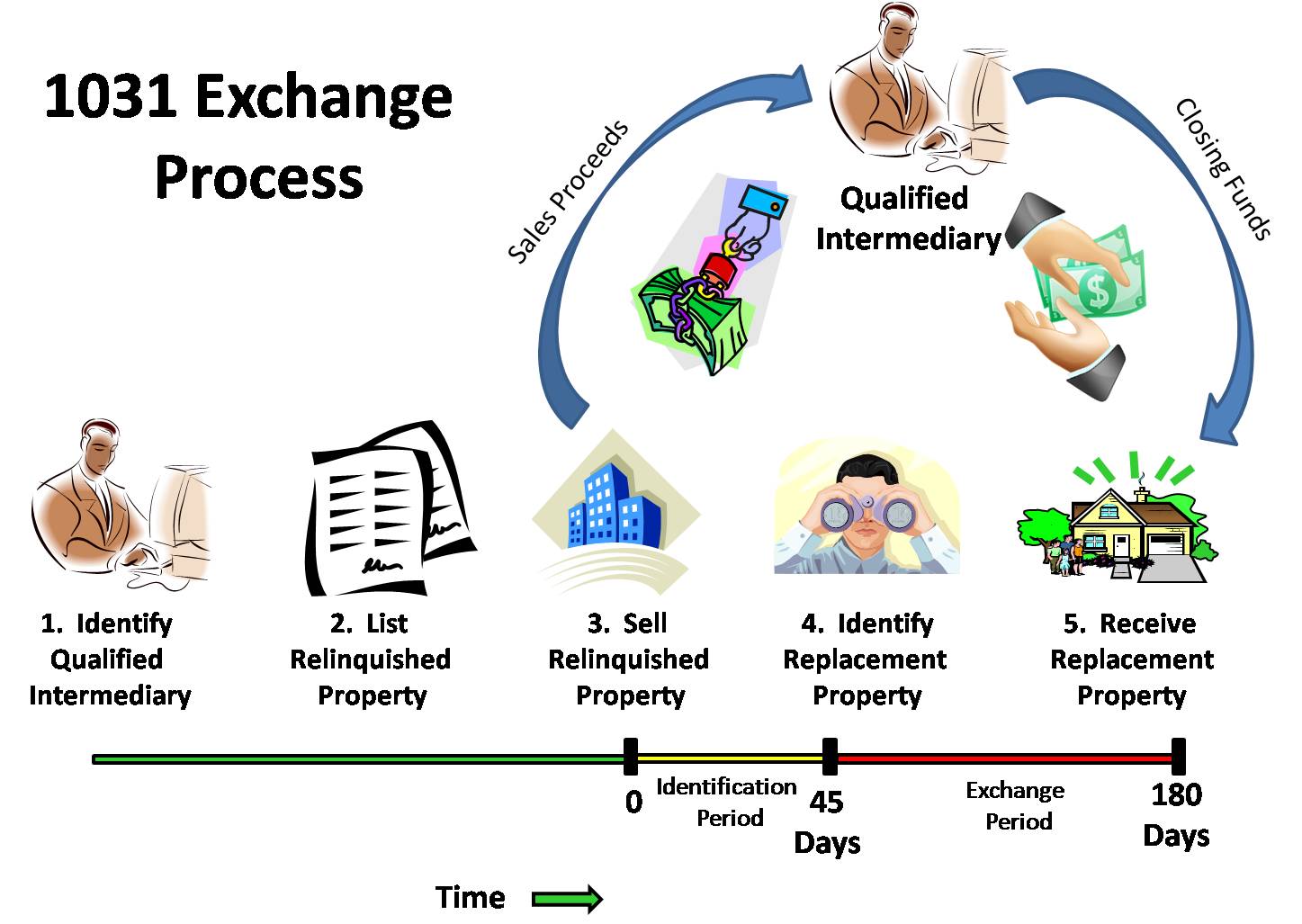

First step is to contact your realtor to get a valuation of your investment, then decide on an exchange plan of action. At that time, hire a third party “qualified intermediary” such as Exeter1031 or Exchange Resources to help facilitate the transaction. Title companies such as Placer Title Company can also help make all arrangements with an exchanger. The seller will need enter into an “exchange agreement” with their intermediary, then prepare to sell their downleg property with their realtor. The qualified intermediary will stay connected to the seller as a neutral third party throughout the process and ensure each transaction is closed and recorded properly for the exchange. Here are some resources provided by Mark Turok at Exeter1031:

- A Guide to 1031 Exchanges©

- A Quick Reference Guide to 1031 Exchanges©

- 1031 Exchange Videos

- Qualified Intermediaries Are Not Created Equal©

- Exeter Corporate Brochure

How long do you have to complete a 1031 exchange?

A seller has 45 calendar days from when their downleg property closes escrow to identify a new property. Initially, a seller must initiate intent to complete a 1031 exchange when selling the downleg property. The seller cannot receive cash during the transaction like a typical sale or reinvestment to qualify for the benefit, the 1031 must be an exchange.

The seller can choose up to 3 properties as potential upleg properties during the process. These properties are identified by their legal description and address, signed by the purchasers and provided to the third party “qualified intermediary” assisting with the exchange. If the purchaser wishes to choose from more than 3 properties, the total value of all upleg properties must not exceed 200% the value the downleg property, these rules get complicated and it is risky. Consult your real estate professional at the time of transaction and ensure you follow each rule or you may be subject to a taxable “boot” or the full tax amount due immediately. The upleg property must close escrow within 180 days of the downleg property closing escrow.

Is there a limit to how many times one person or entity can exchange properties?

There is no limit to the number of exchanges that can be done. An exchanger can continue transferring properties until they pass and never pay capital gains. They can then can gift the property to the heirs. Their heirs will have to pay estate taxes, however, will not need to pay the income tax on the deferred profits from the 1031 exchange(s). The heir(s) will be subject to income tax if they sell the property, that tax will be based on the difference in value for the property at time of death and sale. Consult your tax attorney to make the best financial decision on transferring or gifting your property involved with an exchange when planning the transfer. Ensure the proper type of estate trust is set in place for your individual situation.

What types properties are eligible for a 1031 exchange?

All real property that is used for trade, business or to generate income can be exchanged under Section 1031, as long as it is not a principal residence or property that is personal use property for self or family. If the property is rented to family, it must be at fair market value. One investment property can be exchanged for any other type of investment. Example, an apartment complex can be exchanged for a shopping center or a duplex be exchanged for a commercial building. They do not need to be the same type of investment property, just a property producing income.

Does the value of the new upleg property need to be higher than the downleg property disposed of?

Yes! There is no need for a tax advantage on gains made if there is a loss or no profit made. If an investment property is sold and a new investment property with a lower market value is purchased in its place, the transaction is not eligible for an exchange. The equity held in the upleg property must be greater than the equity in the downleg property.

Can I exchange my primary home?

A seller cannot exchange their primary residence. The purpose of the exchange is to reduce the tax liability from “business income” that is not yet realized. A primary residence is not used to produce income. Should a person decide to convert a primary residence to an investment and become eligible for exchange, they must not live in the property for 2 years and claim the investment. If a property purchased as part of a 1031 exchange wants to be converted to a primary residence, it must be owner occupied for 2 years and owned for a minimum of 5 years. Again, these rules get sticky. Consult your real estate professional and tax professional when making these decisions to see what is most advantageous for you.

Can I purchase my upleg property, before the downleg property sells?

Yes, but this turns it into a “reverse purchase” and not a 1031 exchange. A reverse purchase becomes much more complex and it is difficult to obtain the same tax advantage. A reverse purchase also becomes more costly. Consult a tax attorney or qualified intermediary prior to making the decision on your purchase or sale.

How do I notify the IRS

When the transaction is completed and transfer done, you will file a internal revenue Form 8842 in the next tax year. You should consult with your tax professional and ensure the proper methods are used throughout the process for your individual situation. A 1031 exchange may not always be the most tax advantage option, consult your personal tax consultant prior to conduction your residential sale and purchase plans.

Definitions:

“Like kind” property – Real estate “income” property for a real estate “income” property. IRS definition

“Downleg” – Property being sold by an investor, during a 1031 exchange, for a new property.

“Upleg” – New property purchased or identified to be purchased, as the replacement property, in a 1031 exchange.

Taxable “boot” – If there is an non-qualifying taxable portion of a transaction involved in a 1031 exchange, that portion will be subject to capital gains tax. This can include purchasing a non-qualifying property in exchange, taking cash out or applying for mortgage assistance.

“Qualified Intermediary” – Is a third party qualified to help in conducting a 1031 exchange, can be affiliated with the title and/or escrow company. They must have access to a trust account to deposit funds and must not be related to the transaction. A real estate broker can assist in the exchange, if they are not assisting in the sale or purchase. It is advised to get a contract with your intermediary prior to listing. Your real estate agent professional can help you make arrangements with this person.

Bianca C. Wittenberg

California Real Estate Broker & Realtor Since 2010

- California Investment & Residential Property Specialist

- Sacramento Real Estate Broker and Realtor Since 2010

- Sacramento State MBA Entrepreneurship & Global Business

- Experienced with first time buyers, veterans, sellers, FHA homes, VA, REO & beyond.

Do you have Real Estate questions??? Ask me!

Own It Real Estate

CalDRE#01527420

Rules of the 1031 from the IRS, tax code “(a)Nonrecognition of gain or loss from exchanges solely in kind (1)In general No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of like kind which is to be held either for productive use in a trade or business or for investment. (2)Exception for real property held for sale This subsection shall not apply to any exchange of real property held primarily for sale. (3)Requirement that property be identified and that exchange be completed not more than 180 days after transfer of exchanged property For purposes of this subsection, any property received by the taxpayer shall be treated as property which is not like-kind property if— (A) such property is not identified as property to be received in the exchange on or before the day which is 45 days after the date on which the taxpayer transfers the property relinquished in the exchange, or (B)such property is received after the earlier of— (i) the day which is 180 days after the date on which the taxpayer transfers the property relinquished in the exchange, or (ii) the due date (determined with regard to extension) for the transferor’s return of the tax imposed by this chapter for the taxable year in which the transfer of the relinquished property occurs.” https://www.law.cornell.edu/uscode/text/26/1031

5,915 total views, 4 views today